Clean bus

The market for electric buses and alternative energies is evolving very rapidly. New technologies are arriving on the European market, and if three years ago, the idea of seeing hydrogen-powered buses circulating in major European cities still seemed unusual, it is now becoming a reality. The market is evolving rapidly for several reasons: the awareness of many elected officials that they must act quickly to address the climate issue, the evolution of technologies and the development of new alternative energies to replace diesel, the regulations that are coming into force and are pushing forward the decision-making process, and finally the arrival of new manufacturers who are boosting the historical manufacturers in their product developments, thus offering a vast choice.

Although the electric bus market has taken a little longer to get off the ground than was originally forecast, orders are now being received and the trend for the coming years is for strong growth in demand for clean buses. In Europe, diesel vehicles are still very present in the fleet, and it will take time to completely transform it to zero emissions. That said, countries are getting busy and implementing local actions in parallel with the new European regulations to quickly switch their fleets. In 2017, a report by Bloomberg New Energy finances reported that there were 2,198 electric buses in the European fleet. This is less than what had been predicted by various European analysts, but it is still promising. Because if the orders recorded over the year 2017 were 1,246 electric buses in Europe, the same amount of vehicles ordered was already recorded in September 2018. This gives a cumulative order of electric buses of about 2,500 vehicles in 2018 alone!

However, many purchase decisions are still being postponed and the fateful date of 2025 is when the market will really take off. In the meantime, cities are actively preparing. For some, it is the renewal of vehicles that is concerned, such as Barcelona, which has announced that by 2025, 100% of bus orders will be for zero-emission buses, while for Copenhagen it will be as early as 2019. For others, it is the complete modification of the fleet that is announced, as in Paris, where 100% of the fleet will be low or zero emission by 2025 (i.e. 4,500 buses), or Amsterdam, where the fleet will be 100% zero emission by 2025.

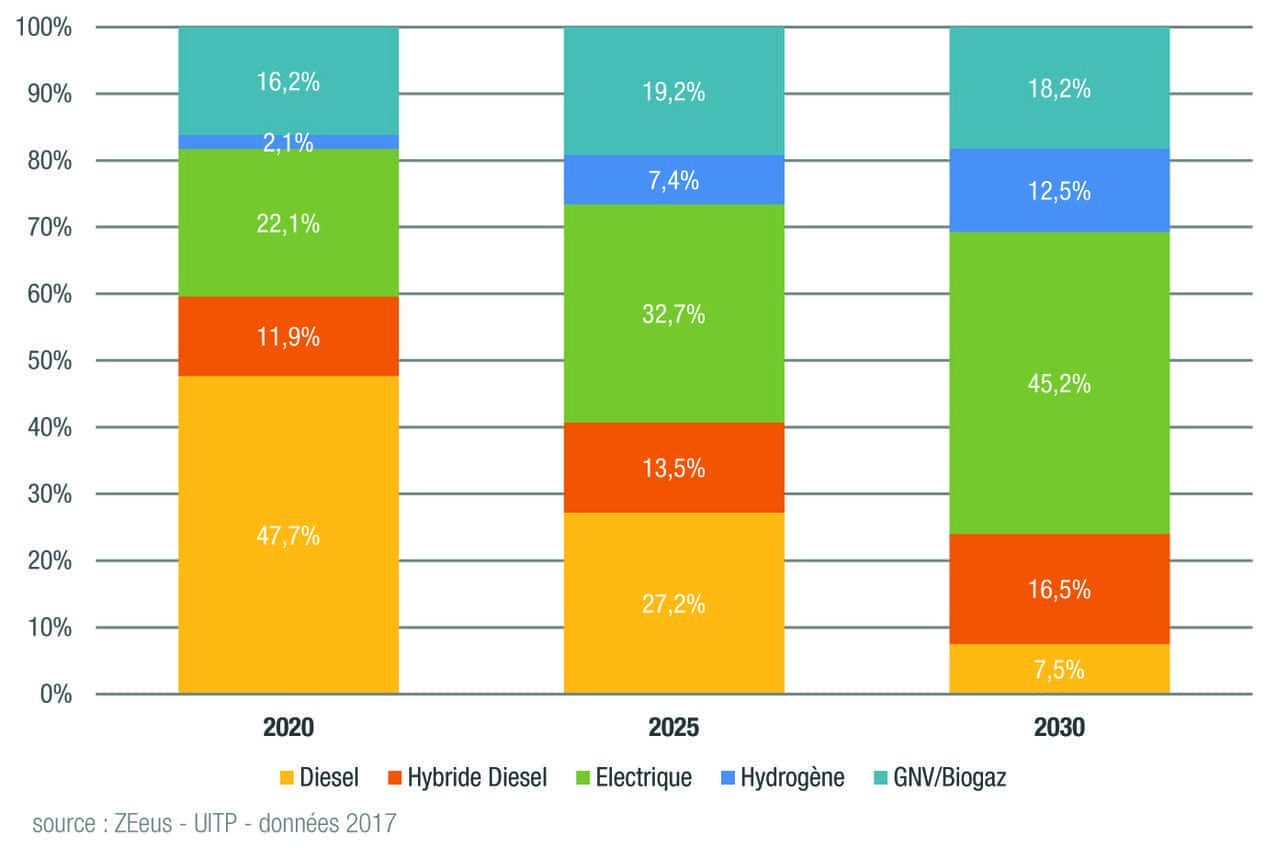

To date, the countries that are moving the most are, in order, Great Britain, Germany, the Netherlands, Lithuania, Austria, Belgium, Poland, Sweden, Spain and finally France. Europe is still a long way from reaching the level of development of China, which to date has deployed 341,000 electric buses out of the 345,000 that make up the world’s electric bus fleet! However, forecasts suggest that the number of electric vehicles delivered in China will fall as early as 2025, with only 80% of the world market, instead of 99% as at present. Thus, for the next 5 years, Europe remains a very promising market. On the forecasts released in 2017, 13,000 electric buses were announced in 2025 in the different member states. But with the revision of the European directive (see previous article page ?), the minimum targets for the acquisition of clean vehicles are likely to increase this figure even further: 45% on average (depending on the country) of new acquisitions will be clean vehicles in 2025, and this figure will rise to 65% on average for 2030.

Today, the vehicles that meet the criteria announced in this directive correspond fairly well to what is on the market. Pure electric vehicles, whether they are depot-loaded or in-line, are very often those that are requested by cities. In fact, this is the category in which we find the most manufacturers, including those from Asian countries. The offer is even very oriented towards electric charging at the depot, which seems to be the most installed solution to date. And yet, it is not without constraints… Indeed, in order to obtain sufficient autonomy, it is necessary to carry a significant quantity of batteries, which not only increase the cost of the vehicle, but also the mass, thus reducing the passenger capacity. No need to remind you that the primary vocation of a public transport vehicle is to transport people, not batteries! Another constraint of the slow charge bus is that it takes time to recharge. On average, a bus with a 300 kWh battery needs to be recharged for 6 hours at the depot during the night. This implies that all vehicles are recharged at the same time and that the energy supply must therefore be very substantial at the depot. In addition, there is the problem of space, as the depots must be redesigned to accommodate all the electric vehicles at the same time in the appropriate safety conditions. Also, despite a higher investment cost in the case of a bus in opportunity charging, this version is certainly the most relevant in pure electric, in terms of vehicle operation. The charge is fast and can be done at any time of the day. But the installation remains costly and requires heavy administrative procedures.

Beyond these various purely technical and logistical constraints concerning pure electric vehicles, it is also important to bear in mind that pure battery technology requires the use of rare metals for the manufacture of batteries (2 tons of lithium used in each bus) and that these batteries are not manufactured in Europe, which undoubtedly creates an Asian dependency in this market.

It is with these issues in mind that SAFRA has been working on a hybrid version of the Businova project since its inception, allowing it to operate not only in pure electric mode. The rechargeable hybrid electric version combines the electric drive train with a hydraulic motor to increase the vehicle’s torque, as well as a range extender (diesel or CNG). This type of motorization remains as relevant as ever, particularly for cities that wish to make a smooth transition to a sustainable fleet. The Businova’s structure also makes it easy to upgrade the vehicle to a more environmentally friendly engine if they so wish. Finally, it is the only hybrid vehicle on the market that can run in zero emission mode on demand. This is a very interesting feature for driving in clean zones.

We can therefore conclude that many electric solutions are currently available on the market, but the developments do not stop there. The arrival of hydrogen in the world of transport is attracting more and more interest. For a long time, hydrogen technology has interested the transport sector, but it is really since 2 years that we see an acceleration in the development of the offers and an increase in the demand. The market forecasts show a strong increase in market share, with a growth from 2.1% in 2025 to 12.5% in 2030. Hydrogen technology is therefore still in its infancy and is proving to be a great alternative to what is offered today in the public transport sector.

In a world facing ever more pressing environmental issues, transition

“A stone has no hope of being anything other than

The fourth leading cause of mortality in the world, air